Cocoa derivatives market

study guide

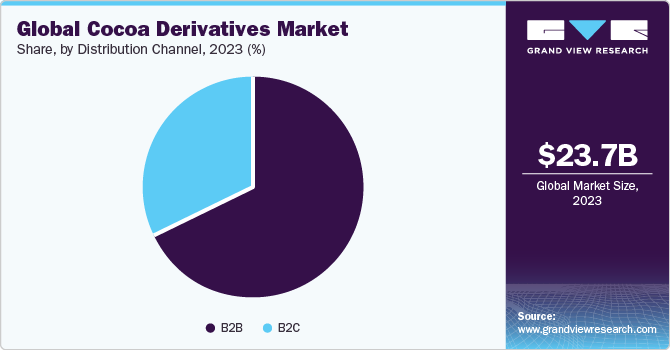

“The global cocoa derivatives market was valued at approximately $23.66 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.10% from 2024 to 2030. The cocoa derivatives industry is experiencing rapid growth due to increasing demand for cocoa. Several companies in the industry are investing in this trend to meet this demand.”

“Demand for cocoa derivatives is likely to increase as more consumers become aware of and seek out certified and sustainably sourced products. As retailers continue to emphasize and expand the supply of certified cocoa derivatives, it further boosts market demand for these products. Additionally, such initiatives by large retailers contribute to the overall growth and demand for cocoa derivatives. For instance, supermarkets and retailers in the Netherlands, such as COOP, and in the UK and Switzerland, like Waitrose, offer certified chocolates.”

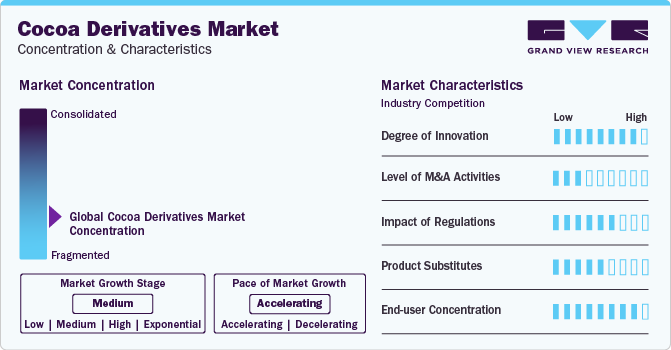

“The global cocoa derivatives market is characterized by a high degree of innovation, with new products and processes being developed and introduced at regular intervals. Several market players, such as Olam Group Ltd. and Barry Callebaut AG, are engaged in merger and acquisition activities. Through M&A activities, these companies can expand their geographical reach and enter new regions.”

Annual compound growth rate of cocoa powder

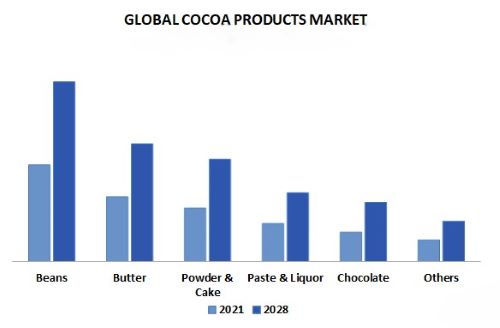

“The cocoa powder segment held the largest revenue share in 2023. Cocoa powder is widely used in the bakery and confectionery industry to add chocolate flavor and color to a wide range of products like cakes, cookies, and brownies. The popularity of baked goods and chocolate-flavored confectionery items has driven the demand for cocoa powder. The rising middle-class population in emerging economies, especially in countries like China, India, and Brazil, has led to increased demand for chocolate and cocoa products. With rising disposable incomes in these regions, there is a greater inclination towards luxury and indulgent food items, boosting the demand for cocoa powder.”

Annual compound growth rate of cocoa butter

“The cocoa butter segment exhibited a significant CAGR over the forecast period. Cocoa butter is widely used in the cosmetics and personal care industry. It is an excellent natural moisturizer and emollient, making it popular in skincare products like lotions, creams, and lip balms. The demand for natural and organic skincare products has been on the rise, and cocoa butter’s soothing and nourishing properties have made it a sought-after ingredient. Additionally, innovations in the cosmetics and food industries have fueled the demand for cocoa butter. Manufacturers are continually exploring new formulations and applications for cocoa butter, leading to increased demand across various product categories.”

“In July 2021, Cargill Beauty announced the launch of sustainably sourced cocoa butter. Cocoa butter possesses a specific crystal structure that contributes to its fast melting and skin nourishing properties.”

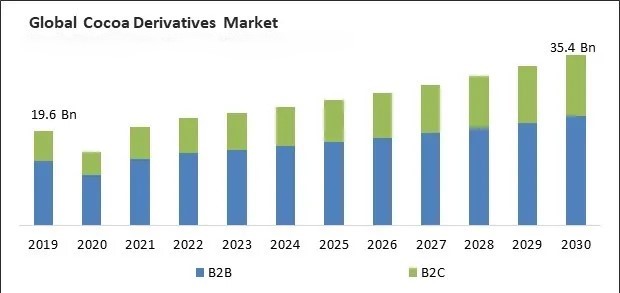

How to distribute in the global market

“Based on the distribution channel, the market is segmented into B2B and B2C. The B2B segment held the largest share in 2023. There is an increasing focus on sustainable and ethical cocoa sourcing, leading to a demand for certified cocoa derivatives. Many B2B buyers, such as confectionery and food manufacturers, prioritize sourcing cocoa derivatives from sustainable and socially responsible suppliers. B2B buyers are closely collaborating with cocoa-growing regions and farmer cooperatives to promote sustainable practices. They may provide training, technical assistance, and financial support to help farmers improve agricultural techniques and adopt more sustainable methods.”

“The B2C segment is projected to grow at the fastest CAGR during the forecast period. The increasing trend of convenience and on-the-go consumption, especially in urban areas, has led to a surge in demand for cocoa-containing products. Consumers are increasingly seeking quick and indulgent snacks, resulting in higher sales of chocolate bars, chocolate-coated snacks, and ready-to-eat chocolate products. In July 2021, NOMOCHOC, a UK-based chocolate product provider, announced the launch of a plant-based chocolate in the B2C segment at supermarkets. The vegan chocolate range will be available in Sainsbury’s and Holland & Barrett.”

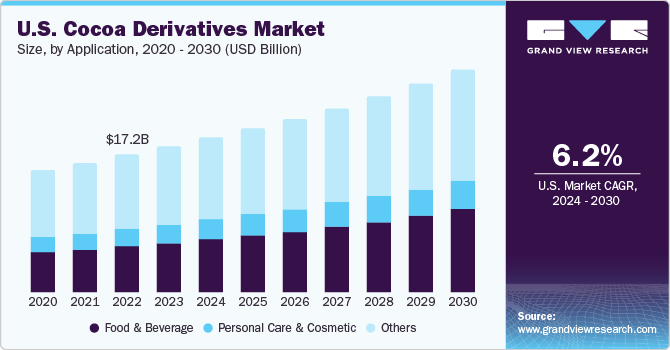

The share of food in the demand for cocoa derivatives

“The food and beverage segment held the largest share in 2023. The rising demand for premium and indulgent food and beverage products has boosted the popularity of cocoa derivatives such as cocoa mass/liquor. These derivatives are often associated with high-quality and indulgent offerings, appealing to consumers seeking unique and luxurious chocolate experiences. In July 2022, OFI, a subsidiary of Olam International, announced the launch of organic fractionated cocoa powder. This cocoa powder can be used in the confectionery, dairy, and bakery industries.”

“The personal care and cosmetics segment is projected to witness the fastest CAGR during the forecast period. Consumers are becoming more aware of the potential health benefits of cocoa derivatives when applied to the skin. Cocoa’s association with antioxidant properties and potential skincare benefits is attracting consumers seeking natural and beneficial ingredients in their beauty routines. Sensient Cosmetic Technologies offers Natpure Xco Choco CC864, derived from cocoa shells, which is easily soluble in personal care, hair care, and skincare products.”

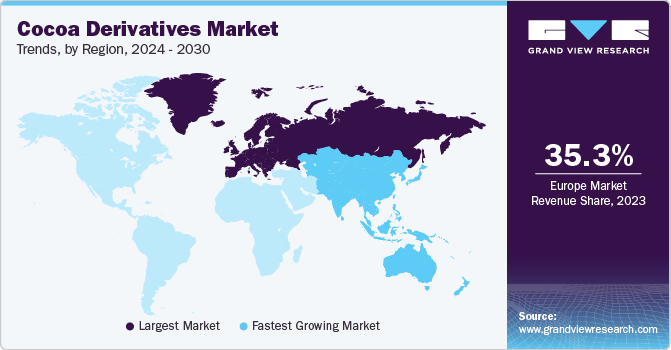

The share of countries in the cocoa market

“Europe dominated the market in 2023, holding a 35.3% revenue share. Europe is a diverse market for cocoa processing. Additionally, the growing trend of single-origin chocolate is also boosting demand for the cocoa derivatives segment. The UK market is projected to exhibit the fastest CAGR over the forecast period.

The Asia-Pacific market is expected to grow at the fastest CAGR from 2024 to 2030. Demand for cocoa ingredients in confectionery and baked goods is witnessing significant growth in the region. Factors such as a growing middle-class population coupled with rising disposable income among the youth are driving the demand for cocoa-based derivatives.

North America is expected to witness a steady growth rate due to the rising demand for sustainably sourced cocoa products, which is boosting the demand for cocoa derivatives in the region.”

Cocoa market companies and stakeholders

**”Olam Group Ltd., Cargill Inc., Barry Callebaut, JB Foods Ltd, and Ecuakao Group Ltd are some of the dominant players operating in the market.

Barry Callebaut has a global presence and operates in approximately 160 countries worldwide.

Ecuakao Group Ltd offers cocoa liquor, natural cocoa powder, cocoa beans, and cocoa mass/liquor.”**

Key companies of cocoa derivatives

Olam Group Ltd

Cargill Co

ناترا SA

JB Foods Ltd

Ecokao Group Ltd

United Cocoa Processor Inc

Indcre S.A

Barry Callebaut AG

Moner Cocoa SA

Altinmarka Gida ve Tic AS

“In August 2022, Indian healthy snack company Lil’ Goodness launched a prebiotic cocoa powder. It contains 100% reduced fat, is rich in antioxidants, real cocoa, and natural prebiotic fibers derived from papaya, soy, citrus, and cocoa beans.”